Appraisals, Taxes and the IRS

Appraisals for the IRS, State of Oregon, and Property Taxes

Appraisals for IRS – Estate Taxes on Real Property

Oregon Estate Taxes on Real Property (State)

The appraisal process can be confusing and difficult at the time of Inheritance or an Audit. Nathan says his job is to connect with you, and simplify the process for you. At Bernhardt Appraisal, the number one job as a real estate appraiser is to be credible.

Real Property Gifts (IRS)

Donated Real Property (IRS)

Tax and IRS Home Appraisal Resources in Portland, Oregon

Contact Us

Start the conversation…

How can I help with your real estate appraisal?

Tax and IRS Home Appraisal Resources in Portland, Oregon

Contact Us

Start the conversation…

How can I help with your real estate appraisal?

We have collected some videos that you may find helpful during this time.

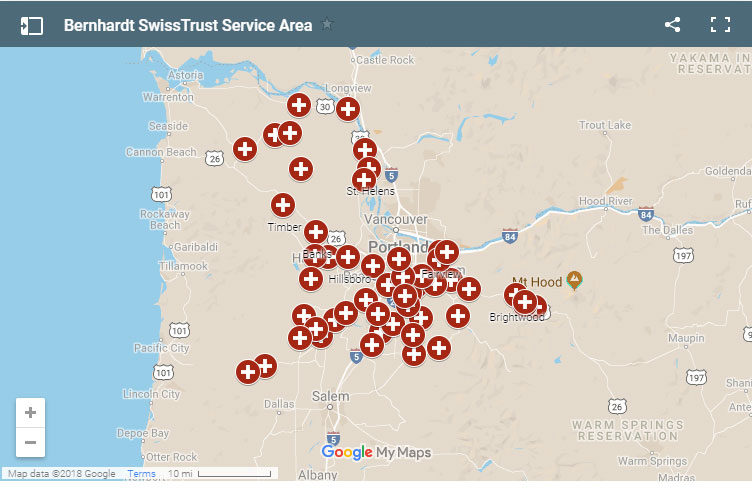

Find your location in our service area.

Portland, Aurora, Banks, Beavercreek, Beaverton, Birkenfeld, Boring, Brightwood, Canby, Carlton, Clackamas, Clatskanie, Colton, Cornelius, Damascus, Dayton, Deer Island, Dundee, Estacada, Fairview, Forest Grove, Gaston, Gladstone, Gresham, Happy Valley, Hillsboro, Hubbard, Jewell, Lafayette, Lake Oswego, McMinnville, Milwaukie, Mist, Molalla, Mulino, Newberg, Oregon City, Portland, Rainier, Rhododendron, Sandy, Sheridan, Sherwood, St. Helens, Timber, Troutdale, Vernonia, Warren, Welches, Wemme, West Linn, Willamina & Wilsonville

Bernhardt Appraisal is proud to be associated with these reputable institutions.

Latest Posts for Divorce Appraisal

Home Appraisals: Spend a Little, Get a Lot

People often complain about the cost of home appraisals. Invariably, they say something like, “I could buy groceries for a month”, or “a piece of furniture for that amount”, or “that’s half my mortgage payment”. So why do people do it? Why do they buy home appraisals,...

Portland Home Prices Amidst the Coronavirus Pandemic

Recent conversations with west coast realtors, investors and appraisers shed some light on how the Coronavirus Pandemic in Oregon has will predictably affect the housing markets, home values over the next 6 months to a year. Zillow Home Values for Portland, OR shows...

Fear of Coronavirus is Bigger than Coronavirus

Bernhardt SwissTrust Appraisal takes Coronavirus COVID-19 Seriously.

As an appraisal company, heavily invested in real estate markets, we are anti-fear, pro-safety. We want life to go on, and this includes appraisals.

Request Your Home Appraisal

Doing our job, doing appraisals right, doing right by our clients and associates.

Call OR Text Us at 503.349-3765